Do This First - Finance 001 for Techies

401Ks and ROTH IRAs are the financial droids you've been looking for

I haven't decided on an intro yet. And, different ones work for different folks, so pick the one that works for you. Or, skip straight to the nitty gritty.

This post is for folks who are overwhelmed or procrastinating on figuring out their finances. It's a distillation of all the financial books I've read over the past 25 years with proof in the practical application that I've been doing for 20.

There's lots of nuancied advice out there. Often overwhelming. The key here is to get started.

You've heard that before. This time, I'm going talk walk you through the where what and when of how to do it.

I'm in a discord with a bunch of amazing designers, developers, and generally creative people. Some of us have been in the industry for decades. Others are just starting.

The topic turned to finance in a recent thread. Some folks in the earlier parts of their careers wondering what they should do and being overwhelmed by all the financial advice that's out there.

Theres so much of it and, like a lot of things, assumes you already have some knowledge of what's going on.

A good one is: https://www.daveramsey.com/dave-ramsey-7-baby-steps

But, that's incredibly hard to do. the thing about starting with the 401K is it's set it and forget it.

(Yeah, this is me telling you to do something different than a multi-millionare financial adviser)

But, his advice doesn't fit my brain.

If this fits your brain. This is the path to take.

TKTKT Satisficing - https://en.wikipedia.org/wiki/The_Paradox_of_Choice

This post is for you if any of the following are true

Note

This is a digital garden post. A work in progress. I'm still shuffling words. Anywhere you see TKTKTKT it means I don't know what to put there yet. Come back and it'll be different, but the message will be the same.

you don't yet have a 401K and/or a ROTH IRA

TKTKTKT

Techies and designers want *the** answer. The perfect solution. The one that sings and does all the things.

Unfortunately, that doesn't work with finances. There is no *one** answer.

Most of us:

weren't taught good financial habits, and

weren't presented good models because our parents and guardians weren't taught well either

Combine those impacts and we lock up. A low level fear creeps in that we'll do the wrong thing. We hate that.

There's good news though, my friends. I found a happy path:

Setup your 401K

You've heard that before. You've heard a thousand things before. But, there's no dev server to play with. No sketchbook to draft in. So, how do we find a solution amongst the noise? By finding existing systems that work.

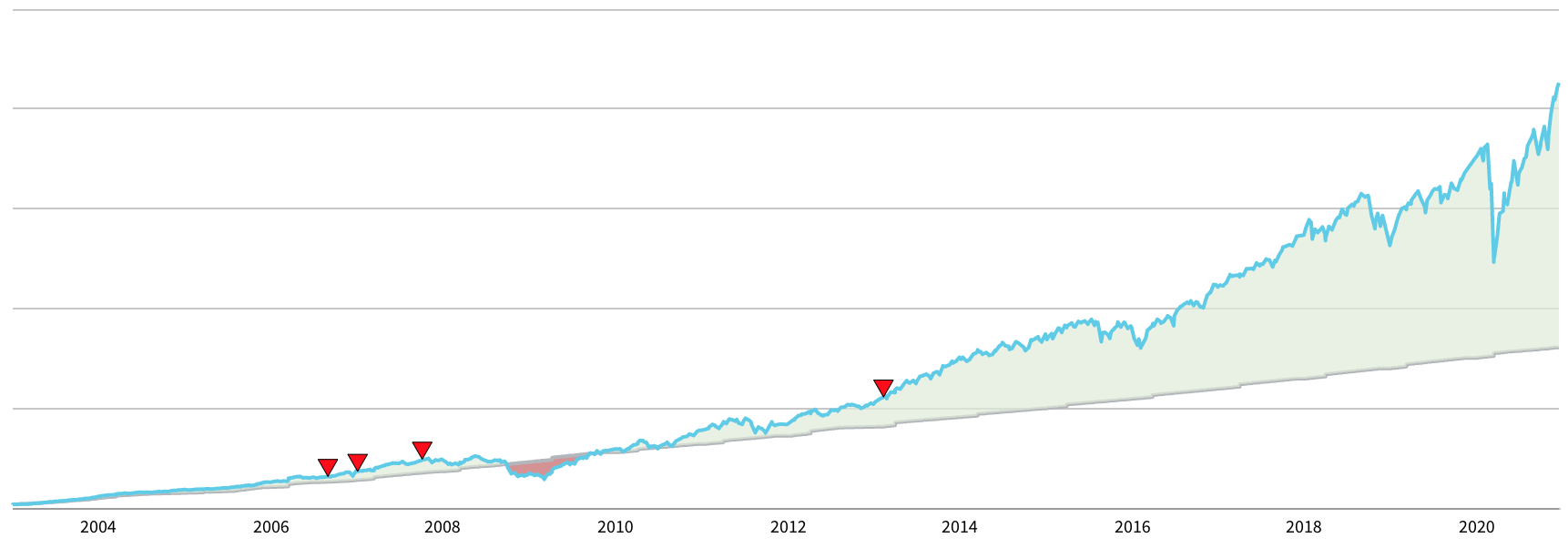

After twenty years testing in production, I'm happy to report the system I put in place works phenomenally. The results so far look like this:

A 401K Performance graph going up and to the right

That gray line on the bottom of the chart is the money I put in.

The blue line that rides above the green area is the amount of money in the account now. Measure it and you'll see that the current value is more than 2x what I put in.

Besides the up and to the right, it's got some other things going for it:

In the 20 years since I set it up, I've only adjusted it 4 times. All times toward simplicity

I forget about it.

Ask my manager who I need to talk to do sign up for my 401K.

Talk to the person in HR to get the sign-up details. While you're doing this, ask if there's "an employer"

Go through the sign-up process (which will likely have a crappy UI) and choose ROTH 401K

You'll be asked how much you want to contribute. If you're

Talk to your HR deparment to find how how to sign up for the 401K.

Walk thru the signup process. (Warning: the UI will probably be crap)

Prepare your mind for the fact that you're about to do something you don't know how to do. Because we know how to work on the web going into a web environment we don't understand feels doubly intimidating for us.

Go through the sign up process. Expect the UI to be crap but parsable. Remind yourself that the web is your world and that if non-industry folks can do it so can you.

Title Options:

Financial Happy Path Design Specs

Design Specs For A Financial Happy Path

A Techie's Guide to the Financial Happy Path

The Happy Path To Financial Freedom

Financial Freedom Design Specs

TKTKKTKT:

Compound Interest

Roth IRA

Make a top level page and then a part two for more details

You've heard it before, but you've heard a thousand other things as well too. But, I'm a techie who's traveled the road. What I've seen is power.

Combine all that together and we lock up. There's a low level fear of doing the wrong thing. We hate that.

it turns out to be elegant in its simplicity.

Start contributing to you 401K

Finding that solution involves getting our head into the right space, doing research, poking at ideas from different angles until we make our discovery.

Unfortunately, that approach fails when it comes

I'm in a discord with a bunch of designers, developers, and generally creative folks.

The topic of finances just came up. Lots of folks